The Government of UAE adopted Cabinet Decision No. (58) of 2020 Regulating the Beneficial Owner Procedures (hereinafter referred to as Decision 58) on August 24, 2020.

1. Scope of Application:

Procedures provided under Decision 58 shall apply to the registered and licensed Legal Persons in the UAE, including the Commercial Free Zones. The exemptions are companies wholly owned by the Local or Federal Government, and the Financial Free Zones (Global Marketplace Abu Dhabi è Dubai International Financial Centre (DIFC)).

2. Identification of the Beneficial Owner:

In accordance with Decision 58, Beneficial Owner (hereinafter referred to as BO) is considered as a Natural Person who:

1) ultimately owns or controls, whether directly or through a chain, 25% or more of the shares or 25% or more of the voting rights in the Legal Person;

2) controls the Legal Person by means of appointing or dismissing the majority of its Directors;

3) holds the position of a higher management official (manager/director).

It is useful to note that all mentioned criteria of BO identification should apply in consequence - from the first to the last, i.e. the transition to the next criteria is required only if the previous criteria, for some reasons, does not allow to determine the BO.

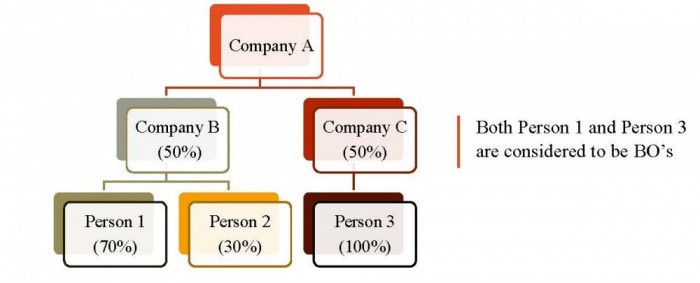

If two or more natural persons jointly own or control a ratio of capital in the Legal Person (more than 25% each), all of them shall be deemed as BO of the company, for example, as shown below:

3. Obligations of Legal Persons

3. Obligations of Legal Persons

Each registered and licensed Legal Person in UAE (above exemptions excluded) should:

1. Create within (60) sixty days of the promulgation date of Decision 58 or date of licensing or registration of the Legal Person, keep and maintain the Register of BO (Art. 8);

2. Update and record any changes to the data contained in the Register of BO within (15) fifteen days of becoming aware of such change (Art. 8);

3. Maintain and secure the Register of Partners or Shareholders and record any changes to the data included in it within (15) fifteen days of becoming aware of such change (Art. 10);

4. Within (60) sixty days of the promulgation date of Decision 58 or date of licensing or registration of the Legal Person, furnish the Registrar with the data contained in the Register of BO and the Register of Partners or Shareholders and carry-out the reasonable procedures to protect these registers from loss, damage, or destruction (Art. 11);

5. Provide the Registrar with the name, address, contact numbers, and a copy of valid passport/ID of a natural person residing in the UAE and authorized to disclose to the Registrar all data and information required by the Federal Decree-Law No. (20) of 2018 on Anti-Money Laundering and Combating the Financing of Terrorism and Financing of Illegal Organizations, The Cabinet Decision No. (10) of 2019 and Decision 58 (Art. 11).

4. Register of Beneficial Owner

The Register of BO shall include the following data in respect of each BO:

a. Full name, nationality, date, and place of birth.

b. Residential address or the address which the notices shall be sent on it, by virtue of Decision 58.

c. Number of passport or identity card, the country of issuance, date of issuance, and expiry.

d. Basis and date on which the person became a BO of the Legal Person.

e. Date on which the person ceased to be a BO of the Legal Person.

5. Register of Partners or Shareholders

The Register of Partners and Shareholders shall include:

a. Number of shares held by each of them along with their categories and associated voting rights.

b. Date on which such partner or shareholder acquire that capacity in the Legal Person.

c. In case of natural partners or shareholders: the full name as it appears on the identity card or the passport, nationality, address, place of birth, name, and address of employer and a true copy of the valid passport or ID.

d. In case of corporate partners or shareholders: name, legal form and memorandum of association, head office address, or the principal address of business (in case of a foreign Legal Person, the name and address of its legal representative in the UAE, with a proof thereof), Articles of Association or any-other similar documents approved by the Relevant Entity in the State, names of the relevant persons who hold higher management positions in the Legal Person, providing their data from their passports or identity cards, including such documents’ numbers, issuance and expiry dates, and issuing entity.

6. Particulars of Nominee Board Members

A Nominee Board Member is obligated to:

1. Inform the Legal Person that he is a nominee board member and provide all the data (analogously to the particulars included in the Register of Partners/Shareholders) within (15) fifteen days of becoming a nominee board member or within (30) thirty days of Decision 58 promulgation date (in case he acquired such capacity prior to the promulgation of Decision 58)

2. Inform the Legal Person of any change to the data within (15) fifteen days of making such a change.

3. Inform the Legal Person that he ceased to be a nominee Board Member within (15) fifteen days of such cessation.

7. Data Confidentiality

Data from Register of BO and Register of Partners or Shareholders should not be in public access. The Ministry of Economy and Registrar shall not disclose to any person such particulars without the written consent of the BO or the Nominee Board Member accordingly.

At the same time, the information from Register of BO and Register of Partners or Shareholders could be disclosed upon a request from the Relevant Entities in respect of international laws and conventions in force in the UAE, particularly the provisions of Anti-Money Laundering and Combating the Financing of Terrorism and Financing of Illegal Organizations.

8. Procedure of Data Provision to the Registrar and Responsibility

Decision 58 came into force on August 28, 2020, therefore, the deadline for creating the above registers and submitting information to the Registrar is October 27, 2020. There is no available public information on the form and mechanism of providing the required data to the Registrar for the sufficient part of free economic zones.

Non-compliance with the new requirements may result in applying administrative sanctions, the list and types of which have not been established as of today.

.